|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Can You Refinance FHA Loans for Better Terms and Rates?Refinancing an FHA loan can be a strategic move for homeowners looking to lower their monthly payments or secure a better interest rate. Understanding the process and requirements can help you make an informed decision. Understanding FHA Loan RefinancingThe Federal Housing Administration (FHA) offers several refinancing options that cater to different homeowner needs. It's crucial to understand these options to choose the best one for your situation. Streamline RefinanceThe FHA Streamline Refinance is a popular choice because it requires minimal documentation and no appraisal. This option is designed for homeowners who want to reduce their monthly payment quickly and easily.

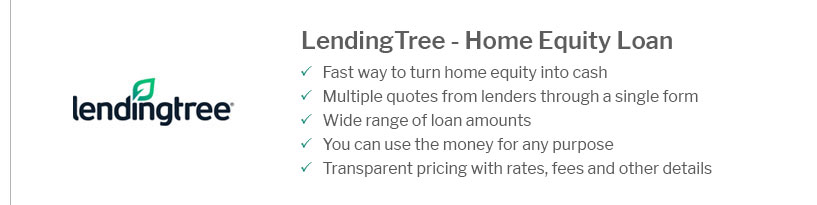

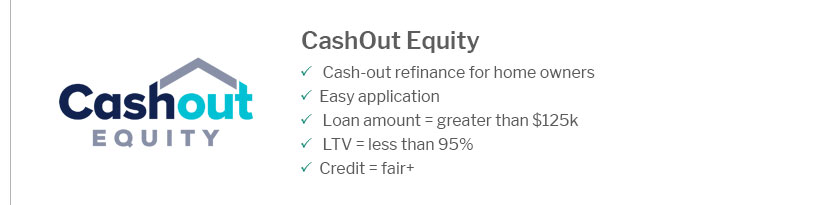

FHA Cash-Out RefinanceThis option allows homeowners to refinance their mortgage for more than they owe and take the difference in cash. It's suitable for those looking to access home equity.

Is Refinancing Right for You?Before refinancing, consider your financial goals and current market conditions. Refinancing may offer lowest refi closing costs if the market rates are favorable. Factors to Consider

Common Questions About FHA RefinancingWhat are the eligibility requirements for FHA Streamline Refinance?To qualify, borrowers must have an existing FHA loan, be current on payments, and demonstrate that the refinance will result in a tangible net benefit. Can I refinance to get a lower interest rate?Yes, refinancing can help you secure lowest refinance rates no closing costs, especially if market rates have dropped since you obtained your original loan. Are there any costs involved in FHA refinancing?Yes, like any refinance, there are closing costs involved. However, these can often be rolled into the loan amount. ConclusionRefinancing your FHA loan can be a beneficial move if done under the right circumstances. Evaluate your current financial situation, consider your long-term goals, and explore the various refinancing options available to determine the best path forward. https://www.freedommortgage.com/learning-center/articles/refinance-fha-to-conventional

If you want to refinance your FHA loan, you may be able to choose between two loan types. You can refinance your current FHA loan with a new FHA loan, or you ... https://www.fha.com/fha_article?id=3192

Homeowners should know that if you want to refinance your current mortgage with an FHA Streamline refinance option at least six payments must have been made on ... https://money.usnews.com/loans/mortgages/articles/can-you-refinance-an-fha-loan

Homeowners with FHA loans can refinance to either a new FHA loan or a conventional loan, as long as they meet eligibility requirements. The ...

|

|---|